If you’re looking to get into commercial real estate, FortuneBuilders offers advanced and comprehensive investing education courses and guides that contain virtually everything you need to know to get started.

“According to the NCREIF Property Index (NPI), “the top-performing CRE sector right now is industrial.” Comprised of warehouses, manufacturing facilities, refrigeration and storage assets, data centers and other assets, industrial real estate is actually outperforming apartment, office and retail sectors by a large margin.

It is worth noting, however, that while commercial real estate is incredibly appealing in 2019, it remains too expensive for the average investor to consider—or, at least, it was. While investing in commercial real estate does come with a higher price tag, one new trend is leveling the playing field: crowdsourcing. The ability to crowdsource a commercial real estate investment is not only becoming more feasible, but it’s also more common than ever. The ability to crowdsource funds for investing in commercial real estate now gives real estate investors the opportunity to transition from residential deals into commercial deals, which bodes well for a bright future. That said, it’s fair to assume we will start to see more small investors breaking into the commercial world.”

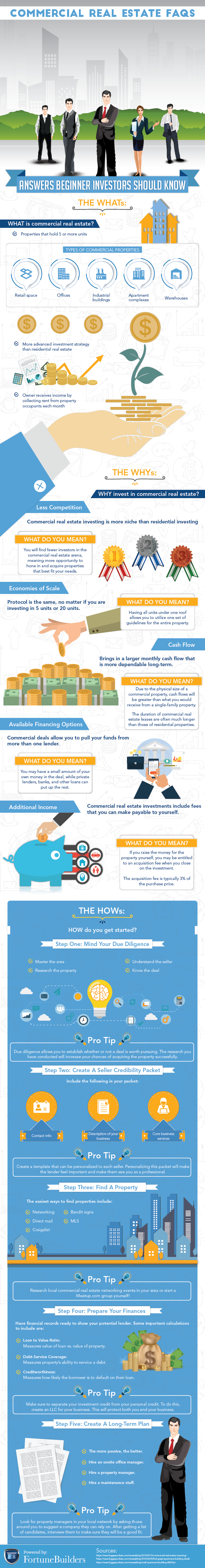

This informative post covers topics:

- What Qualifies as “Commercial Real Estate”

- The 5 Types of Commercial Real Estate

- Owner Occupied Commercial Real Estate

Read more: A Guide to Real Estate Investing – from Fortune Builders.